Checked by the Top One Trader editorial team, experienced traders and analysts are committed to providing reliable, practical insights for funded trading success.

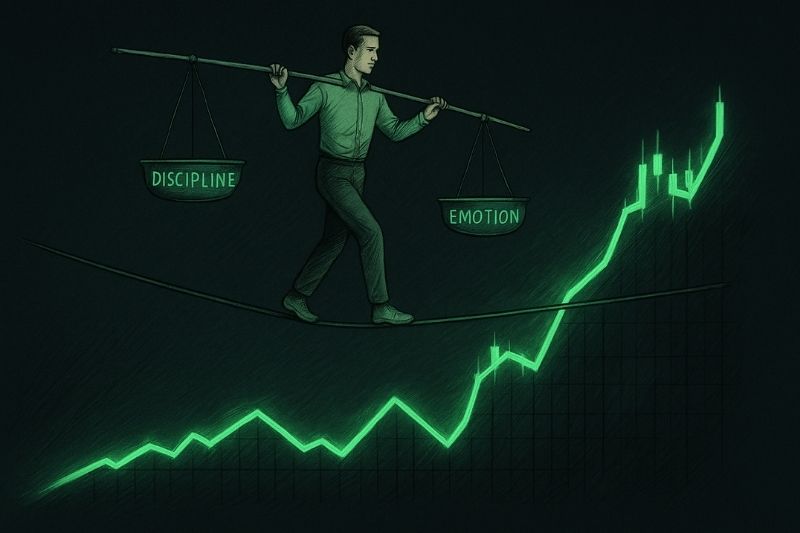

Trading success isn’t just about spotting the right setup; it is about how you think and react once you are in the trade. Two people can use the same strategy and still end up with completely different results. The real difference lies in mindset, discipline, and how you handle pressure.

In this guide, you will see why trading psychology matters, how successful traders stay consistent, and how habits like journaling and structured routines shape a stronger, more focused trading journey.

Key Takeaways

- Forex trading psychology is not about eliminating emotions; it’s about building systems that manage them so you can stay disciplined and follow your plan under pressure.

- Consistency comes from structured routines, journaling, and strict risk management that strengthen your mindset and support your trading journey.

Understanding Cognitive and Behavioral Biases in Forex Trading

Recency Bias

This bias makes traders overvalue recent events. After a few wins, confidence surges and position sizing grows. After a loss, hesitation takes over. In both cases, the trader abandons the plan and reacts emotionally.

Fix: Analyze at least 20–30 trades before drawing conclusions. Long-term averages, not the last few results. Stay consistent and stick to your trading plan.

Confirmation Bias

Confirmation bias makes traders focus only on information that supports their existing view while ignoring contradictory signs in the market. For example, a trader bullish on GBP/USD might search for positive forecasts and overlook technical signals of weakness.

Fix: Before entering any trade, write down one reason not to take it. This habit builds objectivity and helps you make more informed decisions based on logic, not emotion.

Loss Aversion

Losses feel roughly twice as painful as equivalent gains. Traders caught in this bias often move stop losses further away or hold on to a losing trade for too long, hoping the market will turn around. This behavior leads to significant losses and sometimes excessive risk-taking, especially when emotion overrides logic.

Fix: Set a predefined stop loss at a logical level that clearly invalidates your trading idea once the price reaches it, and never change it during the trade. Also, you can move it to the entry level (breakeven) when the price goes in your favor to protect your position in case the market reverses.

Outcome Bias

You judge your decision by the result, not the process. A random win reinforces a poor habit, while a disciplined trade that loses feels like failure.

Fix: Review trades based on rule-following, not profit. Successful traders rely on discipline, not luck, knowing that process-driven habits lead to better trading outcomes.

Actionable Checklist: Audit Your Own Bias

Review your last 20 trades, note moments of hesitation or emotion, and tag repeated biases in your journal

Managing Psychological Pressure in Prop-Firm Challenges

Challenge Phase Pressure and Profit Targets

Picture this. You are in a two-phase challenge, having cleared Phase 1 and needing just 1% more profit to get funded. The finish line is close, and psychology starts to take control. Many traders feel the urge to trade faster, increase lot sizes, or take poor setups to reach the goal. Profit targets create urgency that often turns a focused mindset into reckless behavior.

Fix: Slow down and focus on process over outcome. The challenge is not a race but a test of patience, discipline, and consistency. Set small objectives, such as 0.5% per session, instead of chasing the total target. Trust your plan, stay calm, and trade based on structure, not emotion. Prop firms reward consistency, not impulsive decision-making.

Drawdown Anxiety

During evaluation or funded stages, drawdowns trigger strong emotional reactions. Consecutive losses can cause stress or impulsive behavior. Some traders freeze, while others revenge-trade to recover quickly.

Fix: Accept that drawdowns happen to every trader. No method works all the time. What separates professionals is effective risk management. Use stop losses, limit daily and weekly risk, and size positions conservatively. In most prop-firm accounts, risking 0.25 to 0.50 percent per trade keeps your psychology intact and your capital protected.

Ready to trade in a professional environment that supports your growth?

Join Top One Trader and access powerful trading platforms, expert support, and educational content designed to sharpen your skills. Choose the challenge that fits your style and experience the difference of trading in a professional, supportive environment built for discipline and consistency.

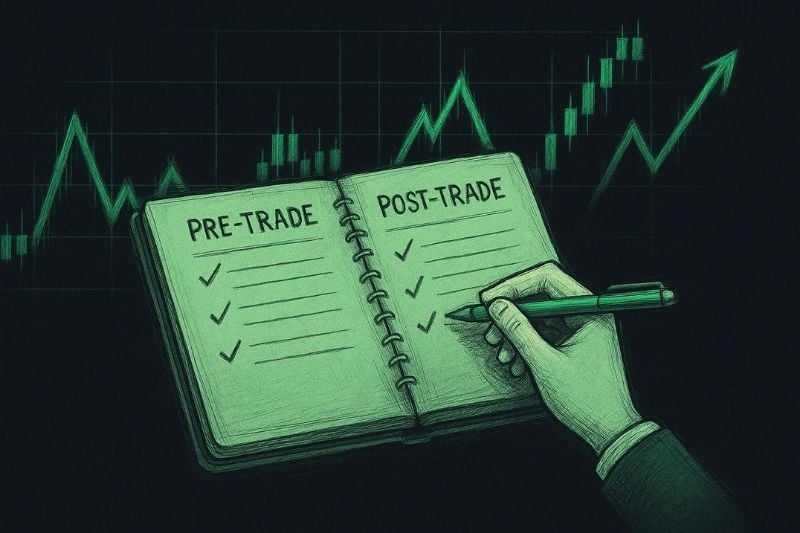

Pre-Trade and Post-Trade Routines

Discipline doesn’t come from motivation; it comes from repeatable structure. Pre- and post-trade routines help transform psychological control into measurable consistency. These routines turn trading into process management rather than emotional reaction.

Pre-Trade Preparation

Think of this as your warm-up before entering the market.

- Market Review: Scan major currency pairs, assessing market participants’ sentiment through both fundamentals and technical analysis.

- Position Sizing: Adjust exposure based on risk tolerance, session volatility, and recent performance.

- Focus Reset: Take 30–60 seconds to reset, stretch, breathe, or visualize your process.

- Intent Statement: Say aloud or note, “Today I follow process, not results.” It reinforces discipline through identity and awareness.

These steps ensure you enter each session calmly, ready to make informed decisions rather than act impulsively.

Post-Trade Review

After closing a trade, emotions peak whether it’s a win or a loss. Post-trade analysis helps separate logic from emotion.

- Emotional Rating: Score from 1 (calm) to 5 (tilted).

- Process Check: Did you follow your trading plan?

- Lesson Capture: Note one insight, such as “impatience before London opens.”

- Reset: Step away from charts for five minutes before reviewing again.

By keeping this structure, you turn psychological factors into data, improving clarity over time. Even three minutes of reflection each day can prevent cascading mistakes and strengthen your mental discipline.

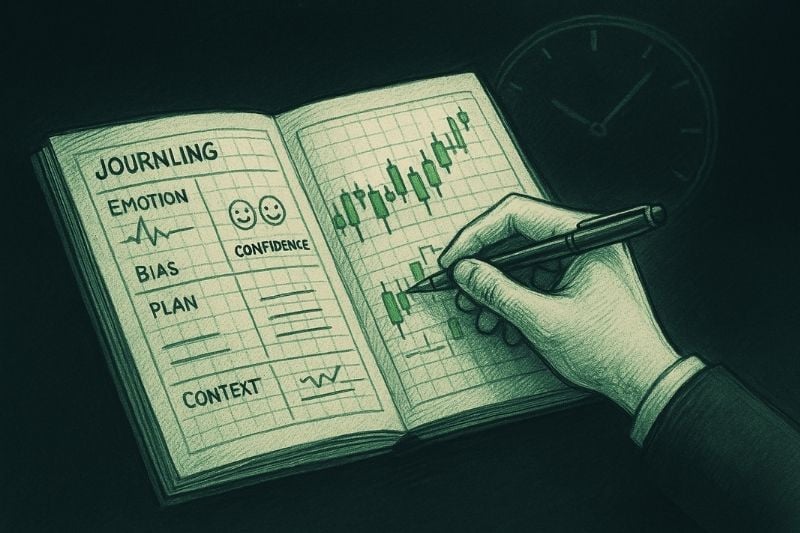

Journaling and Updating Your Trading Plan

What to Record

- Emotion tags: Fear, impulse, confidence, fatigue.

- Bias notes: Recency, confirmation, loss aversion.

- Plan adherence: Did you follow your strategy rules?

- Market context: Session, volatility, and structure.

Scoring System

Rate discipline instead of profit.

- 10/10: Perfect execution following plan.

- 7/10: Minor deviation.

- 5/10 or less: Major breach or emotional trading.

When reviewed weekly, this data shows where discipline slips and how risk management strategies can stabilize performance. Over time, you will start trading based on process rather than emotion, a defining habit of successful forex trading.

Weekly Review and Adjustment

Step back once a week to identify behavioral patterns.

- Do impulsive trades appear at specific hours?

- Does fatigue affect decisions near session close?

- Are losses larger after strong winning streaks?

From these insights, update your plan not only the technical trading strategy, but also the psychological rules. For example: “Avoid trading after three consecutive wins” or “Pause after midday if focus drops.” Journaling turns self-awareness into structure and process-driven growth.

Recovery Protocols After Losing Streaks

Every forex trading journey includes losing streaks. What separates professionals is how they respond. Emotional phases can distort rational thinking, increase stress, and lead to emotional trading.

Step Back Before Acting

When frustration builds, your ability to think clearly declines. Pause trading for 24–72 hours and reset your focus. Review your last ten trades without charts to identify recurring mistakes. This pause protects both your capital and your mindset, two pillars of solid risk management.

Identify Emotional Triggers

Losing streaks are often caused not by the system but by emotional responses to market volatility. Common triggers include:

- Fear of missing out → overtrading low-quality setups.

- Loss aversion → refusing to close bad trades.

- Recency bias → reducing size after one loss.

- Revenge trading → entering impulsively to win back losses.

Note these triggers in your trading journal and track them weekly. Awareness transforms reaction into data and control.

Rebuild Gradually

Avoid the temptation to win back losses quickly. Reduce position sizes and focus on execution.

| Phase | Objective | Risk per Trade | Things You May Do |

| Normal Trading | Strategy is performing well. Maintain consistency and confidence. | 0.5% | Continue following your trading plan, journal each trade, and track performance metrics. |

| Drawdown Period | Protect capital and manage emotions during a losing streak. | 0.25% | Reduce position size, take fewer trades, focus only on A+ setups, review strategy and execution, and avoid trying to recover losses quickly. |

| Recovery Phase | Rebuild gradually and regain rhythm after a drawdown. | 0.5% | Start small, maintain discipline, and focus on consistency before considering any increase in risk. |

This structure restores calm and improves trading performance while keeping your risk-reward ratio and risk tolerance consistent.

Reset Mind and Body

Mental fatigue affects decision quality as much as bad analysis. Prioritize rest, exercise, and hydration. Use short breathing sessions before the chart review. A clear mind is essential for consistent trading decisions.

Reflect, Learn, and Refine

Once composure returns, revisit your plan. Identify weak areas: patience, discipline, or analysis, and write one corrective rule, such as “Pause after three losses.” Successful traders understand that every losing phase is temporary, but lessons from it last a career.

Developing the Professional Trader Mindset

A professional mindset in forex trading is built through repetition and structure, not motivation. Trading psychology refers to how your mindset, habits, and behavior influence every trade. Professionals approach markets like engineers, using data and risk management strategies to control behavior and optimize decisions.

| Trait | Description | Benefit |

| Detachment from outcomes | Viewing each trade as one of many | Prevents emotional trading |

| Thinking in probabilities | Focusing on the edge, not the single results | Encourages disciplined risk management |

| Commitment to improvement | Tracking emotional and performance metrics | Builds stability under market volatility |

| Continuous learning | Adapting to changing market conditions | Keeps confidence grounded in skill |

Professionals rely on structured habits to sustain consistent trading performance. They refine their trading strategy, align their risk-reward ratio with their risk tolerance, and make decisions based on logic, not emotion.

Daily Mindset Practices

- Begin the day with a 5-minute focus reset.

- Use the affirmation: “Follow process, not results.”

- After each session, rate emotional control from 1 to 5.

- End the week by updating your journal summary.

These small rituals transform mindset management into a measurable habit, the foundation of successful trading.

Conclusion

Trading psychology is not about removing emotion but managing it with structure and awareness. In forex trading, real progress comes from journaling, reviewing, and applying disciplined risk management strategies.

Successful traders understand that consistency and rational thinking define long-term success. They learn from mistakes, adapt to market volatility, and make calm, focused trading decisions.

When structure guides behavior and patience shapes process, successful forex trading becomes the natural result of emotional control and disciplined execution.

Take your trading psychology to the next level with Top One Trader.Get funded with up to $500,000, enjoy a transparent rules set, fast payouts, and a supportive community built for serious traders. With advanced tools, learning resources, and flexible challenges, you’ll have everything you need to turn consistency into long-term success.